June Macro Outlook: The Sweet Spot

How Government Spending is Powering the Bull Market

My main idea is that the economy, especially in the U.S., is in a sweet spot I call "Stable Growth & Disinflation." This means the economy is strong, inflation is cooling down but will likely stick around, and the government's policies are helping things along. This has been great for investments like stocks, bonds, and even cryptocurrency. I've looked at over 40 different markets, and the signs are overwhelmingly positive for these types of assets.

The biggest reason for this is a major shift in how the government is running things. We're now in an era of "fiscal dominance," which is a fancy way of saying the government is spending a lot more money than it's taking in, creating large deficits. This spending pushes the economy forward. Because of this, the central bank (the Federal Reserve or "the Fed") has to keep interest rates relatively low to make it easier for the government to pay its bills. This setup basically puts a safety net under the economy and keeps pushing asset prices higher. The old trends that kept inflation super low for the past 30 years are gone. Now, government spending is the main driver of the economy.

I know some reports point to weaknesses, like in the housing and job markets. However, my way of analyzing the economy tells me not to worry too much about those numbers right now. They are "lagging indicators," meaning they tell you what has already happened , not what's coming next. The more important "leading indicators," like government policy and market momentum, are all pointing up. This makes me confident that it's a time to be invested and take on some risk. I believe the widespread fear of a recession is actually a sign that the market is likely to go up, not down.

The "Stable Growth & Disinflation" Environment

To put it simply, the current market is in a phase where the economy is growing nicely while inflation is coming down. When I look at the data from all sorts of global investments, I see a clear pattern that confirms this. This isn't just my opinion; it's what the market data is telling me.

My rule for investing is to go with the flow of the market, not against it. It's a mistake to try and predict a major crash based on old news or gut feelings.

In this kind of environment, certain investments tend to do better than others:

- Stocks: Riskier stocks, like those in tech or cyclical sectors (companies that do well when the economy is strong), usually beat safer, defensive stocks. Growth stocks tend to do better than value stocks, and smaller companies often outperform larger ones. U.S. and Emerging Market stocks have historically been the winners.

- Bonds: Corporate bonds, both high-yield (riskier) and investment-grade (safer), become more attractive than government bonds. This is because a stable economy means companies are less likely to go bankrupt, making their debt a good investment.

- Commodities: Things like industrial metals and oil do well because a strong economy needs more raw materials. Gold also does well as people buy it as a safeguard against the government's economic policies.

What's Driving This: Government Spending

The engine behind this positive market is a huge, long-term change in U.S. government policy. The government is spending a ton of money, cutting regulations, and occasionally reducing taxes. This isn't just a short-term boost; it's a new way of life for the economy. The forces that used to keep inflation down for decades are gone. Now, government spending is what keeps the economy humming.

A major side effect of this is that it ties the hands of the Fed. To prevent a financial crisis from the massive government debt, the Fed is forced to keep its policies "dovish," meaning it has to keep money flowing and interest rates from getting too high. Its job of fighting inflation has become less important than keeping the whole system stable.

This forces the Fed to keep real interest rates negative (meaning the official interest rate is lower than the rate of inflation). This is the only way for the country to manage its massive debt – by letting the economy grow faster than the interest payments on the debt, which slowly reduces the debt's real value. This situation is incredibly good for the prices of financial assets like stocks. It boosts company profits and makes today's stock prices, which might seem high, look reasonable. From my perspective, long-term government bonds are a bad investment in this scenario. The risk isn't that the government won't pay you back; the risk is that the money you get back will be worth less because of inflation.

Why I'm Ignoring the Recession Fears

My positive outlook goes against many who are worried about a recession. They point to things like falling confidence among home builders and a slight increase in unemployment claims. While those things are happening, I believe it's a mistake to think they signal a coming market crash.

My investment strategy is based on a proven understanding of how economic cycles work. Policy and market momentum are leading indicators – they tell you where things are headed. Employment and credit data are lagging indicators – they tell you where things have been.

The arguments for a recession are built almost entirely on these lagging indicators. The weakness in housing and jobs is the result of the Fed raising interest rates in the past. But the leading indicators I follow are telling a much different, more positive story. This is why I believe the recession worries are a "head fake." I see the economy as being "U-shaped" – a temporary slowdown followed by a strong recovery as the government's pro-growth spending really kicks in. The current "wall of worry" is the perfect backdrop for the stock market to climb higher.

My Approach to Bonds: It's Complicated

My view on bonds isn't one-size-fits-all. The data tells me it's much better to take on "credit risk" (investing in corporate bonds) than "duration risk" (investing in long-term government bonds).

Here's why I'm positive on corporate bonds: The "Stable Growth & Disinflation" environment is perfect for them. The economy is strong enough that companies can easily pay their debts, but inflation is low enough that the Fed won't suddenly jack up interest rates and cause a crisis. This is a great setup for corporate bond prices to rise.

On the other hand, I have a negative view on long-term U.S. Treasury bonds. The government's massive spending and the need to keep interest rates low create a huge problem for these bonds. The real danger isn't that you won't get your money back. The danger is that, due to inflation, the money you get back will buy you a lot less than it does today. My models show that these bonds are fundamentally a bad deal in this new economic era.

Why I Believe in "Hard Assets" like Gold and Bitcoin

My strategy includes a strong recommendation for "hard assets," specifically Gold and digital assets like Bitcoin and Ethereum. My reasoning goes beyond just noticing that their prices are going up (which they are). I see these assets as a necessary protection against the long-term consequences of the government's policies.

When the government constantly spends more than it earns and the central bank has to print money to cover it, the long-term value of traditional currency is at risk. Gold and Bitcoin are valuable because they are scarce, not controlled by any government, and can't be easily devalued.

Therefore, holding Gold and Bitcoin isn't just a side bet; it's a core part of my overall investment thesis. The very same policies that are pushing stocks higher (lots of government spending and easy money) are the same policies that make it essential to own assets that protect you from the declining value of the dollar. Think of it this way: I own stocks to ride the wave of growth created by these policies, and I own hard assets to protect my wealth from the currency debasement that is an unavoidable result of those same policies. Even central banks around the world are starting to see this, as they are buying up gold to diversify away from the U.S. dollar.

My All-Around Macro Portfolio

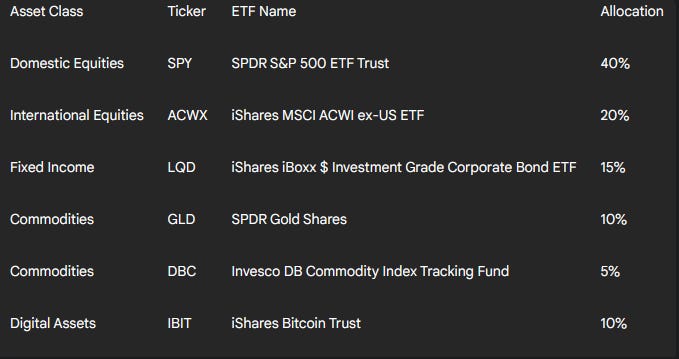

Goal: This is my blueprint for a well-rounded portfolio. It's a diversified mix of up to 10 ETFs that reflects my complete outlook on the economy. It's designed to provide a balanced way for me to invest based on my views. Holding some cash is also a perfectly fine option within this strategy.

My Portfolio Holdings & Why I Chose Them

- U.S. Stocks (40%): Using the SPDR S&P 500 ETF (SPY)This is the biggest piece of my portfolio. I'm focusing on large U.S. companies because they are the main winners in the current "Stable Growth & Disinflation" sweet spot, which is being boosted by government spending. The positive signs for U.S. stocks are strong and widespread, telling me they will likely continue to lead the way. I use the SPY fund because it’s extremely easy to trade and has very low fees.

- International Stocks (20%): Using the iShares MSCI ACWI ex-US ETF (ACWX)This investment adds some global variety to my stock holdings. My research shows positive signs in many countries outside the U.S. that are also benefiting from a stable global economy. Plus, if the U.S. dollar's value softens a bit—which can happen with so much government spending—it would give an extra boost to these non-U.S. investments. The ACWX fund is a great, low-cost way to own a broad range of stocks from around the world (both developed and emerging countries).

- Bonds (15%): Using the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD)This is my holding for bonds. My strategy is to lend money to strong, reliable companies rather than holding government bonds. The current economy is great for these companies; stable growth helps their sales, and lower inflation keeps their costs down. This means they are very unlikely to go out of business, which makes their bonds a solid investment. The LQD fund gives me a simple way to invest in a wide range of these U.S. corporate bonds.

- Commodities (15%): Using SPDR Gold Shares (GLD, 10%) & Invesco DB Commodity Index Tracking Fund (DBC, 5%)I've split this investment into two parts. The bigger 10% slice in Gold (GLD) is my long-term protection. My whole economic view is based on the idea that massive government spending will slowly reduce the value of our currency, and Gold is the classic defense against that. The other 5% in a broad commodity fund (DBC) lets me invest in things like industrial metals and energy, which do well when the global economy is strong and provides a nice alternative to just owning stocks and bonds.

- Digital Assets (10%): Using the iShares Bitcoin Trust (IBIT)This is a strategic investment that I have very high confidence in. I see Bitcoin as a form of money that the government can't control and a powerful protection against the long-term effects of government overspending. It's also in its own tech-driven adoption phase, and it has a history of performing incredibly well when investors are feeling confident and ready to take on risk. I've chosen the IBIT fund specifically because it's the leader in terms of how easily it can be traded and has very competitive fees.