July Trade Review

In last month's review, we looked at how the system handled a challenging position in USO, which required a series of defensive rolls. That campaign, along with another in GLD, remains an open "strategic workout" on our books. This month, we saw the full lifecycle of this process in action: while some campaigns required patience, others that were challenged earlier were successfully managed to a profitable conclusion.

July was another productive month for the portfolio. It served as a perfect illustration of our "claims management" process, demonstrating not just how we handle difficult positions, but how we successfully resolve them.

First, let's look at the numbers.

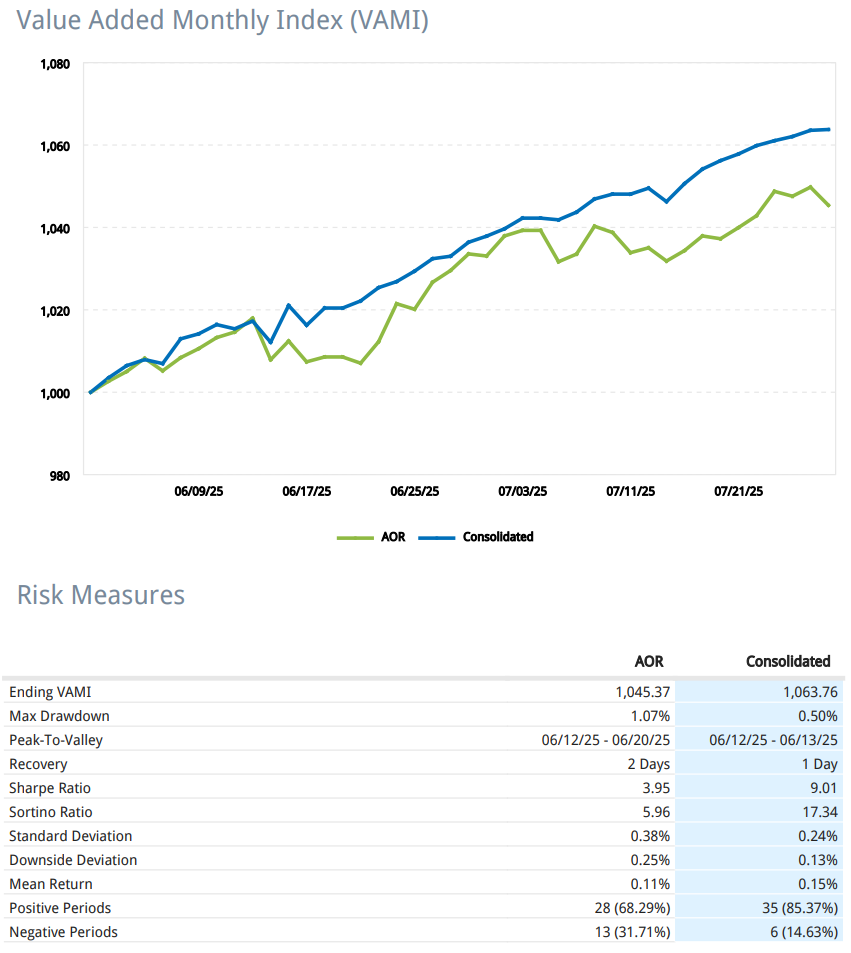

Performance Since Inception (June 2 - July 31, 2025)

- Net Return: +6.26%

- AOR Benchmark: +4.54%

- Sharpe Ratio: 9.01

- Max Drawdown: -0.50%

The portfolio continues to meet its primary objective: generating steady, low-volatility growth that outpaces its benchmark with a fraction of the risk.

The Big Picture: Refining the "Specialty Insurance" Book

The most significant theme in July was the continued refinement of our Diversification Engine. As our "specialty insurance" business, its goal is to write policies on assets that are as uncorrelated to the S&P 500 as possible.

To that end, we closed out the majority of our positions on individual S&P 500 sectors (like XLF, XLP, etc.). While these were profitable trades, they were positions of opportunity, not core strategic holdings. In their place, we began to build new campaigns in assets that offer better diversification, such as VXX (Volatility) , UNG (Natural Gas) , and GDXJ (Junior Gold Miners) . These are inherently more volatile markets, but they align with our macro view and provide a risk profile that is distinct from our core ES positions.

From Red to Green: The Anatomy of a Successful Workout

In June, our SLV and IWM campaigns required defensive rolls and were successfully closed for a profit. In July, we saw the same process play out in our fixed-income book, with both campaigns being successfully resolved.

1. The LQD (Investment Grade Bonds) Campaign: This was a classic example of a defensive roll turning a losing position into a winner.

- The Losing Leg: On July 7, we opened a position in the LQD 11JUL25 108.5 Put. The position was challenged, and we closed it four days later for a realized loss of -$159.65.

- The Roll: As our rules dictate, we immediately rolled the position, opening a new one further out in time: the LQD 18JUL25 108 Put.

- The Winning Leg: This new position was never challenged. We held it for a week, and on July 18, we closed it for a realized gain of +$371.07.

- The Result: The campaign was closed for a total net profit of +$211.42.

2. The IEF (7-10 Year Treasury) Campaign: This campaign followed the exact same script.

- The Losing Leg: On July 3, we opened a position in the IEF 11JUL25 94.5 Put, which we had to close on July 11 for a loss of -$38.70.

- The Roll: We immediately rolled to the IEF 18JUL25 94 Put.

- The Winning Leg: This new position expired worthless, and we closed it on July 18 for a profit of +$206.60.

- The Result: The campaign was closed for a total net profit of +$167.90.

These campaigns are the perfect illustration of why we view our positions as long-term campaigns, not short-term trades. The initial loss is not a failure; it's a managed cost of doing business—a "claim" that we paid out. By systematically rolling the position, we gave the campaign the time it needed to align with our macro view and ultimately resolve profitably.

Ongoing Workouts: The Virtue of Patience

Of course, not every workout resolves in a few weeks. As of the end of July, we have three campaigns that are in an active workout phase.

- USO (Oil): This remains our primary strategic workout. The campaign is still held in the long-dated 16JAN26 65 Put. After accounting for the initial realized losses of -$2,685.04 from June, the position has an unrealized gain of +$1,728.92, bringing the total campaign P&L to -$956.12. Our low-leverage approach allows us to be patient and manage this position without it affecting the rest of our business.

- GLD (Gold): The workout in gold also continues. After taking two losses totaling -$620.00 in June, we rolled into the 15AUG25 295 Put. That position currently has an unrealized gain of +$502.42, putting the total campaign P&L at -$117.58.

- SLV (Silver): After successfully closing our previous SLV campaign for a profit, a new campaign was initiated in July. This one was challenged at the end of the month. On July 31, we closed the 01AUG25 33.5 Put for a realized loss of -$812.48 and immediately rolled into a new position, the 08AUG25 33 Put, to continue the campaign.

July was a textbook month for the system. We saw the "bread and butter" trades in the Beta Engine continue to perform, we refined our specialty insurance book, and most importantly, we saw our claims management process successfully turn two challenging positions into profitable campaigns while continuing to manage our open workouts.